An analysis of Santander bank (SANB11) suggests that Rumo (RAIL3) and Agricultural SLC (SLCE3) are likely to benefit from a situation involving tariffs imposed by China on US commodities and proteins.

The anticipation is for an increase in the need for transportation services in Brazil, along with a transfer of US corn and soy imports to the country, which is likely to result in higher prices due to limited stock levels.

China has imposed a 15% tariff on chicken, wheat, and corn imports from the USA, along with a 10% tariff on sorghum, pork, beef, and dairy products, effective from March 10.

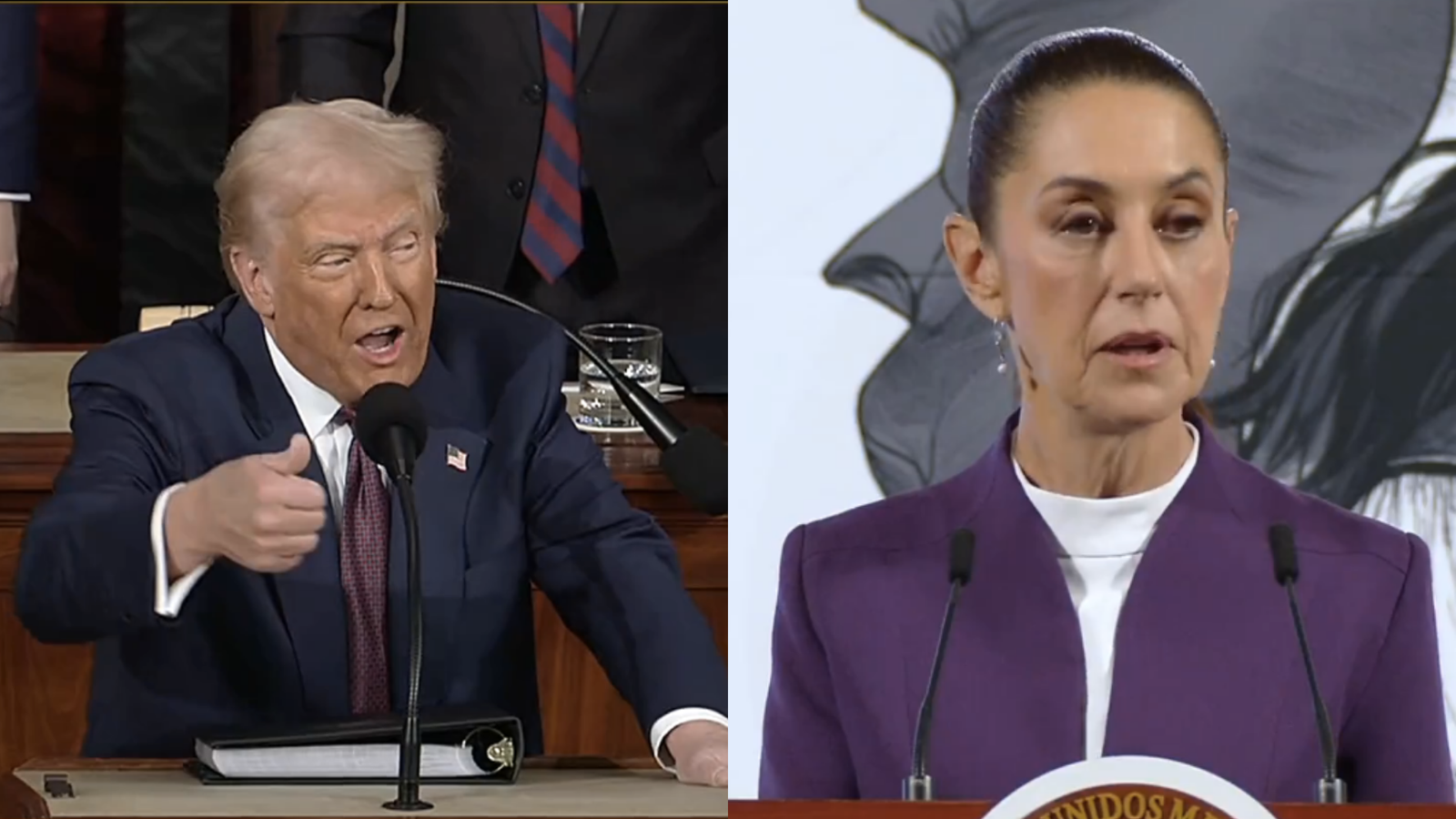

The actions were taken in reaction to extra tariffs of 10% – totaling 20% – imposed by US President Donald Trump on Chinese goods sent to the US.

The new rates are milder compared to the 25% tariffs implemented in 2018, leading to a shift in China’s commodity demand from the US to Brazil, as reported by the “Money Times”.

SLC is likely to benefit significantly from the anticipated rise in demand for Brazilian soy, potentially leading to higher local prices. Other companies like 3tentos (TTEN3) and Boa Safra (SOJA3) could also experience indirect advantages.

Brazil’s primary grain export blend to China can enhance the competitiveness of the key Rumo routes, which run from the Midwest to the Port of Santos. This is due to the lower shipping expenses they provide to China in comparison to Brazilian ports in the Arco Norte.

Santander stated that Rumo could gain advantages from improved volume/price conditions as long as tariffs remain in place.

The bank recommends buying shares of SLC Agricultural (SLCE3) and Rumo (RAIL3) with target prices of R$ 23 and R$ 21 respectively.

The bank has recommended buying shares of SLC Agricultural (SLCE3) and Rumo (RAIL3) with target prices of R$ 23 and R$ 21 respectively.

The suggestion is to buy Boa Safra with a target price of R$15 and to stay neutral on 3tentos (TTEN3) with a target price of R$18.

Santander is set to introduce a special app that provides access to all its services.

Santander plans to introduce a single application that combines all of the bank’s services and products in the coming months, according to the CEO Mario Leo at the bank’s results conference on Wednesday.

The executive explained that the application is being developed in collaboration with the Santander group. He mentioned that while the app may not impact this year’s results, it is a significant move forward.

Santander’s CEO announced that the bank achieved 70 million customers in February, up from 69.5 million in 2024. Over the past three years, the bank has reduced its physical service network by 30%, with plans to further decrease it to 45% or 50% this year.

Comments