Building a financial portfolio that matches the investor’s profile is crucial for long-term success in the realm of investments. Investors inclined towards bold choices and confident in their decisions are likely to find the bold profile most suitable for their investment strategy.

In this article, we will examine the details of this profile and provide advice on creating a top-notch portfolio for assured investors.

What are the traits of a bold investor?

Understanding the bold profile requires knowledge of your objectives, investment timeline, and identifying opportunities, as well as a thorough grasp of the profile’s features.

Investors who have just arrived typically possess a positive outlook on markets, ready to take on higher risks in return for the potential of increased profits. They also tend to exhibit a higher capacity for making swift decisions and have confidence in market analysis.

Simply review the key characteristics of this profile.

Positive outlook and future planning

Confident investors maintain a positive outlook on future market and economic prospects, prompting them to focus on long-term investment opportunities and overlook short-term fluctuations in pursuit of higher returns in the long run.

Dealing with risks in a simple manner

Bold investors recognize the importance of maintaining trust while navigating market fluctuations, acknowledging that overcoming obstacles is essential for achieving higher returns and that resilience is crucial for cultivating a successful, long-term investment portfolio.

Making decisions quickly and efficiently.

Confident investors are not afraid to make prompt and decisive decisions, seizing opportunities in financial markets due to their trust in their analyses.

Accepting calculated risks

Confidence is not about being careless, but about making informed decisions when taking risks. Experienced investors are aware of the connection between risk and potential returns, and they make decisions based on their risk tolerance.

Continuous education and adjustment

Investors who prioritize trust still value the significance of education and are open to adjusting their strategies by seeking knowledge.

Increased diversity in the portfolio’s income sources

Investors who have just arrived tend to keep a higher proportion of their funds in variable income assets as opposed to fixed income assets, as they are typically seeking greater returns despite the increased risks involved.

Provision for unpredictable assets

Investors with a high risk tolerance tend to favor assets with greater volatility, like early-stage business ventures or industries that are not well-established. They are attracted to the possibility of achieving high returns over time, even if it means experiencing large fluctuations in the value of their investments.

Exploring more advanced tactics

These investors seek advanced methods like derivatives and private equity funds to potentially increase returns and safeguard against various market conditions.

Exploring possibilities outside the usual.

Bold investors often explore opportunities in non-traditional sectors such as startups, emerging markets, and cryptocurrencies to diversify and increase potential returns, besides the usual markets.

Geographical spread and involvement in developing economies.

Bold investors often opt for geographic diversification by investing in emerging markets to benefit from the growth of developing economies while also reducing reliance on a single market.

Bold investors prioritize diversification strategies and risk management despite their focus on high-risk assets.

Even in the realm of fixed income, they look for assets with higher risk to diversify the portfolio and reduce potential losses.

Is it essential to be courageous in order to become a more successful investor?

Nope.

Being courageous in investing does not always outperform other investment strategies. This approach signifies a specific risk management style, and there is no one-size-fits-all strategy for all investors.

Different profiles such as conservative, moderate, and bold offer various advantages and disadvantages depending on an individual’s financial goals, investment timeframe, and risk tolerance.

Investors who have just arrived often look for higher returns, but must be prepared to face increased fluctuations, as more cautious investors prioritize safeguarding their capital, even if it results in smaller profits.

Watch this video to gain a clearer understanding of the distinction.

Does practicing Day Trade [or other types of trade] indicate that I am daring?

An investor with this profile may opt not to engage in speculation on the Stock Exchange and still hold a portfolio that includes riskier assets.

Trading operations like Day Trade and Swing Trade are not seen as investments, but as methods to make a profit from price fluctuations between buying and selling.

Not all bold investors have to trade assets on the Stock Exchange to be considered as such, as per the requirements of B3, the Stock Exchange.

Becoming a confident investor – how to do it?

To become a confident investor, it is crucial to adhere to key steps derived from our current knowledge.

Know your finances first!

Boring investors possess a strong understanding of their financial situation. They assess their risk tolerance, set financial objectives, and determine an appropriate investment timeframe before considering higher-risk assets.

Aligning your investment decisions with your personal goals is essential to be ready for market fluctuations.

Be constantly learning

Continuous pursuit of financial knowledge is another crucial aspect.

Bold investors are committed to comprehending the intricacies of the financial market and expanding their understanding of various asset classes like stocks, derivatives, and alternative investments.

They also analyze the dangers linked to different investment types and effective approaches for managing situations of high volatility.

Consciousness in various forms

The daring investor, despite being more willing to take risks, still sees diversification as an essential strategy.

This involves allocating resources among various types of assets, industries, and locations.

They aim to manage risk and maximize returns by limiting exposure to a particular market factor.

Maintain your investments regularly.

Staying informed about the economic situation is an ongoing habit for this investor profile. They remain vigilant about news, economic developments, and potential influences on their choices. This consistent monitoring helps in recognizing opportunities and responding proactively to reduce risks and capitalize on value increases.

Master the skill of emotional intelligence as an added benefit.

Emotional regulation is a crucial ability for the achievement of daring investors.

Even when faced with high volatility, they steer clear of making hasty decisions and remain unaffected by group mentality.

Maintaining emotional discipline is crucial for sticking to the long-term strategy and avoiding impulsive actions that could harm the portfolio’s performance.

Creating a wallet for a confident image.

Assets with fluctuating income

Variable income assets are crucial for constructing a portfolio for daring investors, providing significant return potential alongside elevated risks. Three specific categories stand out in this regard.

Deeds

Investing in activities necessitates a strategic and adaptable method to match the daring profile. Therefore, tactics like active “trading,” which entails frequent buying and selling of stocks, and the creation of varied portfolios, are compelling.

Investing in Initial Public Offerings

Participating in Initial Public Offers (IPOs) provides adventurous investors with the chance to invest in promising companies early on, although they come with higher risks. Bold investors may choose to add IPOs to their portfolios by closely following the company’s potential and investing cautiously.

Investment portfolios

Venture capital funds

Investors seeking to invest in startups commonly discover potential opportunities through venture capital funds. These funds provide funding to early-stage companies to support their development and creativity.

Private equity investments

Private equity funds target established companies looking to expand, reorganize, or undergo strategic changes, offering investors the potential for higher returns in the long run.

Multimarket experiences

Multimarket funds aim for higher returns by employing diverse strategies, including investing in various asset classes, using derivatives, and implementing advanced techniques.

Cryptocurrencies and digital assets

Cryptocurrencies and digital assets provide attractive opportunities for daring investors looking to diversify their portfolios and potentially increase valuation. Three key aspects require careful consideration in this regard.

Cryptocurrencies such as Bitcoin

Bitcoin, being the original and most well-known cryptocurrency, remains appealing to daring investors due to its decentralized nature, capped supply, and growing recognition as a store of value.

Decentralized tokens and digital assets.

Tokens are distinctive assets on a blockchain, commonly utilized in decentralized finance (DeFi) and NFTs (Non-Fungible Tokens).

International investments involve putting money into assets located in foreign countries.

Investing globally is a crucial tactic for adventurous investors looking to diversify and tap into worldwide markets. It is essential to assess the various opportunities when contemplating this strategy.

Global Exchange-Traded Funds and International Activities

Global ETFs and foreign stocks provide a unique opportunity to invest in international markets by offering exposure to a variety of assets from different regions, or by allowing investors to select individual companies in international markets. This flexibility and liquidity are crucial for dynamic international investments.

Alternative forms of investments

INCO platforms provide access to a range of investment opportunities, including startups and real estate projects, making investing more accessible. However, it is important to assess the risks of each project carefully.

How can a daring wallet be diversified?

Boring investors may take on higher risks to achieve better returns, but it is important to diversify investments and make decisions based on calculated risks and thorough analyses to achieve a balance between return potential and managing potential losses.

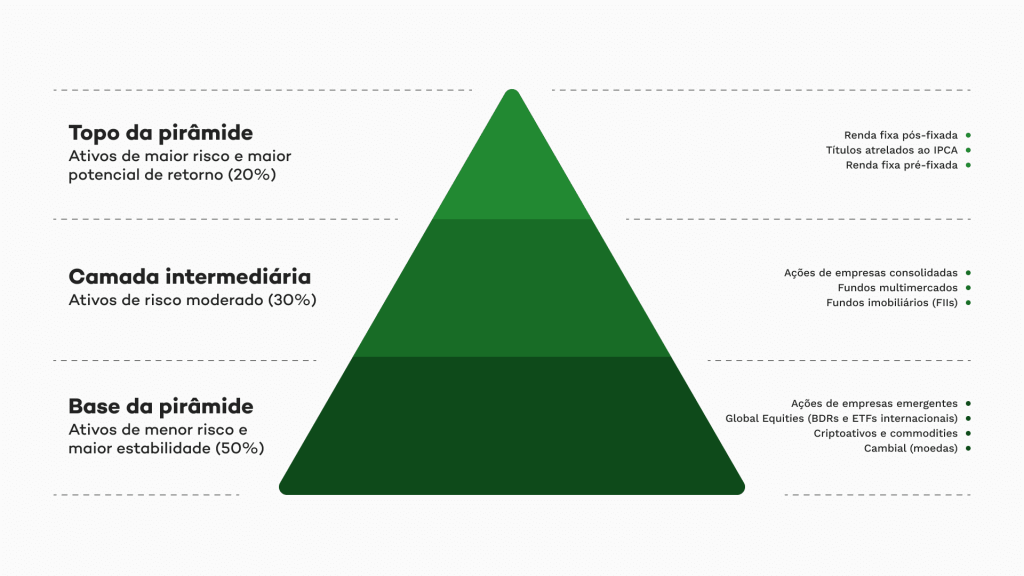

One method to envision the optimal diversification for this profile is to picture the portfolio’s composition as a pyramid segmented into layers.

This pyramid serves as a visual and adaptable guide.

Each level can be modified based on the investor’s characteristics and objectives to safeguard the portfolio from significant losses in a particular sector or asset class.

Additional methods for enhancing security and fostering development

- Avoid focusing investments in one asset or sector to reduce the risk of substantial losses.

- Get familiar with the coverage provided by the FGC: Review Fixed Income products that are protected by the Credit Guarantee Fund (FGC).

- Research defensive tactics to reduce losses during stock market declines, including the use of derivatives and regular portfolio rebalancing.

It is advisable to seek guidance from a financial advisor to make sure your investment portfolio is in line with your objectives and that your choices are based on solid reasoning.

Risk management and strategies for achieving desired outcomes

Three key components in this procedure are:

Assessment of risks and their reduction

Daring investors conduct risk assessment on every asset or strategy, pinpointing elements that could harm performance.

Meaning of stop loss and take profit

Stop loss and take profit are crucial tools used by investors to safeguard their investments and secure profits. Astute investors set predetermined thresholds to minimize losses and secure gains when specific targets are met.

Exit plans for risky investments

Effective outgoing strategies are crucial in high-risk investments, requiring clear return targets, regular reassessment, and flexibility to adapt to changing market conditions.

Portfolio supervision

Monitoring instruments

Investors have the option to utilize online platforms, financial analysis apps, and other technological tools to monitor the performance of their assets in real-time.

Periodic evaluation is crucial.

Regularly reviewing your portfolio enables you to assess performance, goals, and strategies in depth, so savvy investors make it a priority to review their investments frequently, taking into account shifts in economic, political, and market conditions.

In conclusion

The bold profile is distinctive for its courage, confidence, and readiness to pursue opportunities in unpredictable markets.

Therefore, constructing an optimal portfolio for an adventurous investor involves assessing objectives, risk tolerance, and investment timeframe.

Comments