Technology has introduced numerous modifications across all aspects of our lives, including the financial sector. Businesses have embraced smart technology solutions to enhance customer service and streamline different financial transactions.

We have shifted from using traditional banks to digital platforms for managing our finances, including the use of digital currency.

You may be familiar with Techfin and Fintech, two concepts that are shaping the banking industry and business practices.

What do Fintech and TechFin resources entail? What similarities and differences exist between Fintech and TechFin? What opportunities and challenges does TechFin pose for investors, businesses, and entrepreneurs?

We will explore the concept of Techfin and distinguish it from fintechs in this publication. Happy reading!

Techfin concept

TechFin is a service that specializes in providing advice and streamlining processes for financial sector businesses.

The use of technology is involved in replacing traditional methods of delivering financial services.

These technological tools aim to cut expenses, boost output, and maintain consistent workflow across all activities.

The financial crisis in 2008 played a significant role in the rise of “FinTech”, a trend driven by startups since that year.

Fintech firms are now providing services tailored to address particular challenges in the financial industry for customers.

Other prominent technology companies quickly joined the competition by providing their customers with solutions through the development of processes and digital systems.

Jack Ma, the founder of Alibaba, ventured into China’s financial industry in 2016 by establishing “Ant Financial” and is credited with popularizing the term “TechFin”.

TechFin is essentially a financial service offered by a major tech company with a well-established platform and a sizable customer following.

What is the purpose of a Techfin?

Techfins aim to operate in a similar space as fintechs when dealing with corporate customers, as they look to partner with financial institutions and various companies in different sectors to enhance their platform offerings.

Banks prioritize utilizing technology to enhance efficiency and productivity in their financial processes and operations when planning for improvements.

In the financial services sector, efforts are made to expand existing experience and capabilities, eliminating any aspirations for transformation or disruption of the process.

TechFin companies do not consider the disruption because it is what their customers demand.

- Security measures.

- Dependability.

- Steadiness.

- Inheritance.

Read on to gain a deeper insight into the distinctions between fintech and techfin.

What sets Techfin apart from Fintech?

Fintech typically describes a financial firm looking for optimal methods to deliver financial services, with companies using technology to enhance customer service and satisfaction.

A FinTech is usually a new company that finds a gap in financial services, such as a technological area where providers are lacking due to regulations or neglecting digital clients. They aim to offer a solution to this problem by selling it to customers or financial service providers.

Techfin companies are technology firms that aim to offer financial services utilizing current technology solutions. Prominent examples of Techfin entities are Google, Amazon, Facebook, and Apple in the U.S., as well as Baidu, Alibaba, and Tencent in China.

TechFins differ from FinTechs and typically begin with three key elements.

- Technology.

- Please provide more information or a specific text for paraphrasing.

- Clients.

They transition to the finance industry, utilizing their data and customer access to improve services beyond what traditional providers offer, setting themselves apart from Fintech startups.

Fintech is an area where financial services are provided using advanced technology to enhance the user experience.

TechFin involves a company providing technology solutions creating a new method for delivering financial services, with technology and finance being shared aspects but differing in their application.

Techfins offer an innovative experience to customers, making banking processes easier and are not meant to replace banks or brokers.

Techfins are transforming the financial market.

Techfins have made a significant impact in the financial market by emerging as competitors in a field previously controlled by traditional institutions.

The global financial and banking sector is experiencing significant changes in recent years, which are not allowing the industry to adapt and respond effectively.

Traditional banking has transitioned to digital, moving from fiduciary to digital currency. Despite the finance world adapting to these changes, a new trend has emerged as the future of financial and banking systems.

Does this imply the traditional banking system as we know it will cease to exist, given the TechFin sector’s efforts to enter and revolutionize the industry?

The future of finance lies within the financial economy itself, as TechFin and FinTech companies will eventually combine and offer similar services.

FinTech companies analyze current technologies to develop both traditional and new financial services, often leading to disruptive innovations.

TechFin companies believe differently about how technology can be integrated into established company structures to create supportive innovations.

In summary, FinTech and TechFin establishments guarantee customer contentment.

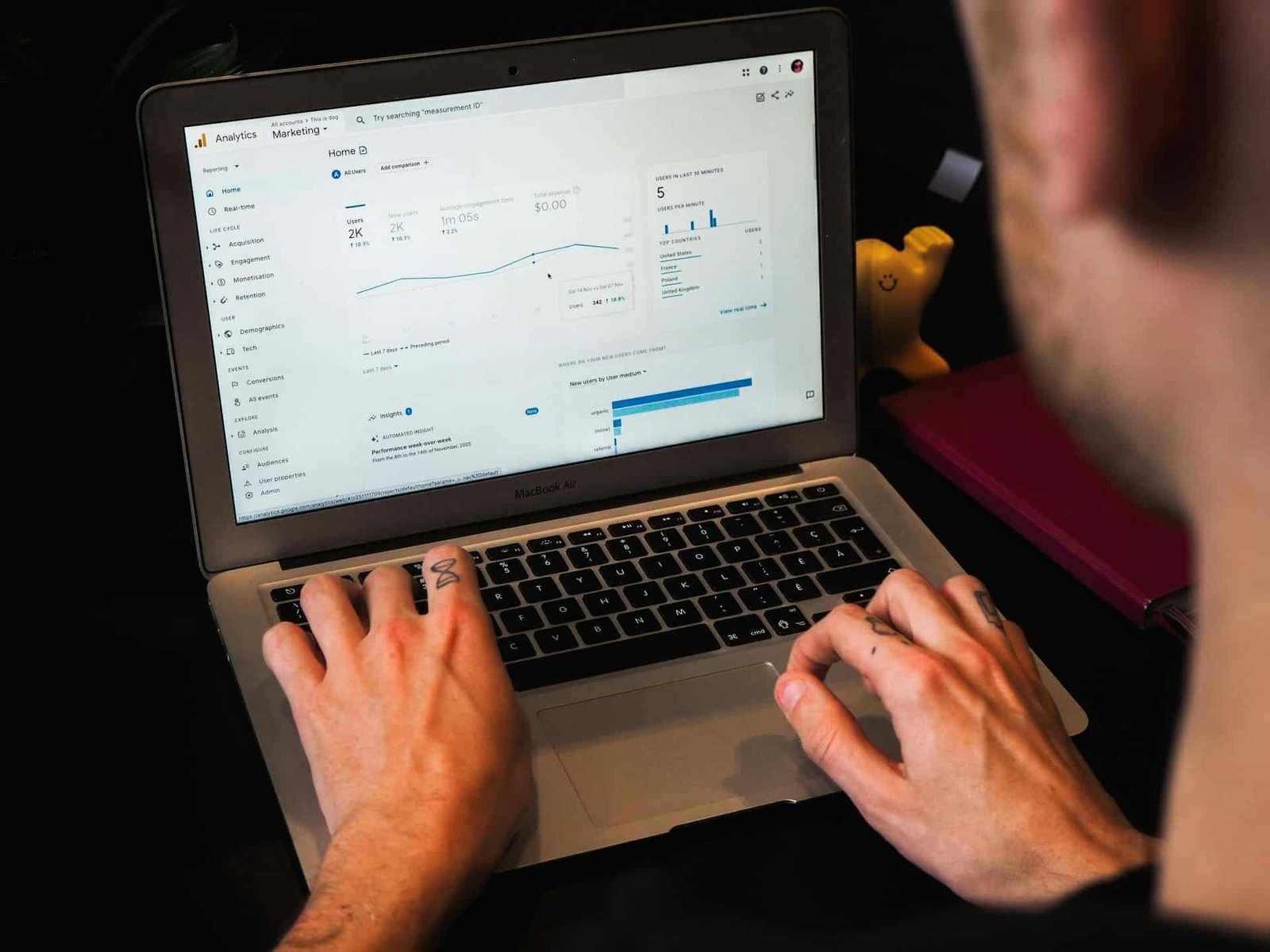

Technology and investments are the key drivers of the financial market trends. Find out more information here.

Summary

The term FinTech refers to financial institutions that utilize technology to enhance customer service and delivery, while TechFin describes technology companies looking to expand into the financial industry.

Comments