In the realm of investments, it is crucial to utilize tools and techniques that aid in decision-making. The Net Present Value (NPV), also known as VPL, is a popular method for assessing investment projects and facilitating sound decision-making processes.

We will discuss the VPL concept and its importance in investment analysis, including its formula and proper application for precise outcomes. Additionally, we will explore how the VPL method can be utilized to enhance investment returns.

Understanding and effectively utilizing the VPL can provide you with a valuable tool to inform your investment decisions and enhance your financial returns. Learn more about how the VPL can be a crucial asset for investors like you.

What does VPL stand for?

VPL is a method used to assess the viability of an investment by determining the current value of future cash flows after adjusting them for the investor’s minimum required return rate, which is also referred to as the discount rate.

The VPL is based on the idea that the value of money fluctuates with time, as a sum received today holds more value than the same amount received in the future, owing to its potential for investment and returns.

The VPL takes into account the time value of money and converts all future cash flows into present value, offering a better understanding of the investment’s financial return.

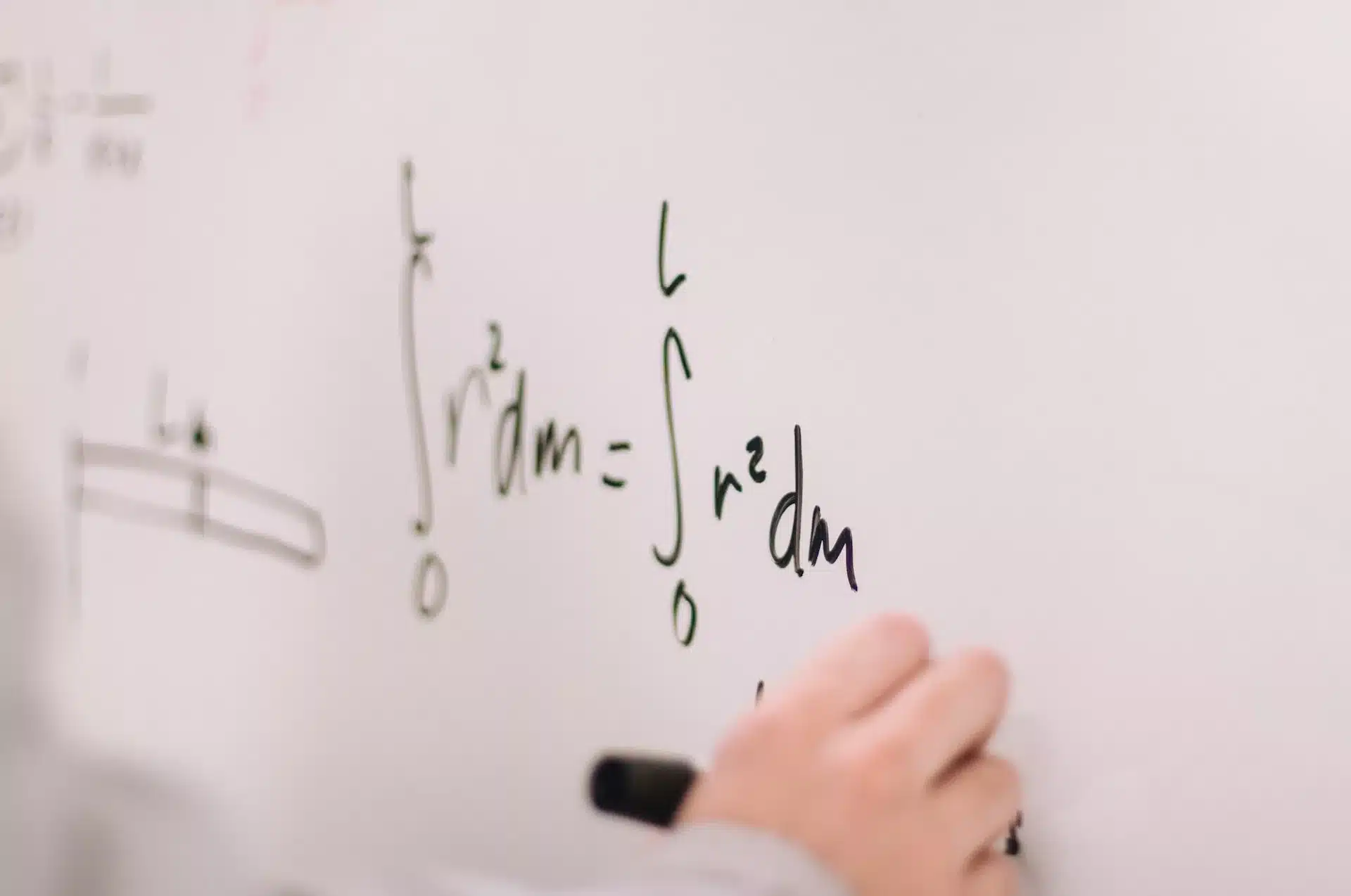

The fundamental equation for the net present value (NPV) is as shown:

VPL is equal to the sum of cash flows divided by the discount factor raised to the power of n.

Where can this be found?

- FC stands for the anticipated cash flows for each period.

- The discount rate, denoted as r, is the minimum return rate that investors require.

- Time period n represents when cash flows take place.

How does VPL function?

Using the VPL of financial investments requires following specific steps.

Estimate the cash flows expected in the future.

The initial step involves creating the projected cash flows throughout the investment period.

Identify all financial inputs and outputs related to investments, including revenues, expenses, interest payments, dividends, and more.

It is crucial to be practical and think about various potential situations.

Establish the rate of discount

The discount rate plays a crucial role in determining the NPV.

It denotes the lowest rate of return necessary for an investor to consider investing.

The discount rate is determined by the cost of capital opportunities and takes into account factors like inflation rate and investment risk level.

It is possible to calculate the NPV using the provided formula by considering the specified box flows and discount rate.

How can the VPL be analyzed?

Analyzing the Net Present Value (NPV) is an essential part of assessing financial investments.

Investors can enhance their decision-making and pinpoint optimal return possibilities by learning how to analyze the VPL.

Some key subjects for a thorough VPL analysis are emphasized next.

Interpreting the outcome of the VPL analysis.

Positive net present value

A positive net present value (VPL) signifies that the investment has a current net return higher than the initial investment, indicating the project’s financial feasibility and attractiveness.

Negative VPL

A negative net present value indicates that the investment is not generating sufficient profits to surpass the initial investment and satisfy the necessary discount rate. In these situations, it might be wiser to explore other investment options that offer higher returns.

VPL is zero.

A VPL of zero suggests that the investment yields the same amount as the initial investment. It is crucial to also evaluate aspects like future growth potential, associated risks, and supplementary tactics to enhance returns.

Examination of the discount rate

The discount rate plays a crucial role in VPL analysis, and it is important to select a suitable rate considering factors such as investment risk, opportunity cost of capital, and expected return rate.

When comparing various investments, it’s crucial to employ a uniform discount rate to ensure a consistent evaluation and conduct sensitivity analyses by testing different discount rates to assess their impact on the NPV findings.

Assessment of cash movements

Having a precise prediction of upcoming cash flows is crucial. It is vital to take into account both the actual amounts and how often they occur consistently in the future.

Cash flows should encompass all pertinent income and expenses, along with any extra investments needed throughout the evaluation timeframe.

It is advised to assess various potential situations, including the optimal outcome, the worst outcome, and the probable outcome, in order to analyze the VPL’s responsiveness to varying circumstances.

Benefits of utilizing the VPL

When it comes to financial investments, it is crucial to depend on tools that facilitate decision-making.

The Net Present Value (NPV) is a commonly used method to assess the viability and potential returns of investment projects.

For those interested in investing, is it beneficial to utilize the net present value (NPV)? Let’s delve deeper into this analysis.

Improved analysis

The VPL helps to provide a more precise evaluation of investment returns by factoring in the time value of money and converting future cash flows into present value, offering a more practical insight into potential net returns.

Comparing Projects

The VPL enables you to impartially evaluate various investment ventures. By determining the VPL for each project under review, you can pinpoint the option that provides the greatest net profit.

This comparison is especially beneficial when you have restricted funds and need to choose between various investment options.

Money’s time value

The VPL considers that a dollar received today is more valuable than a dollar received in the future because of its investment potential and ability to generate returns over time.

The VPL enables a more precise analysis by discounting future cash flows to their present value, taking into account the time value of money.

Based on the rate of discount

The VPL utilizes a discount rate to calculate the present value of future cash flows, which represents the investor’s minimum required return rate and capital opportunity cost.

By selecting a suitable discount rate, investors can factor in their risk tolerance and return objectives, which serves as the foundation for NPV analysis.

Enhanced decision-making through better information.

Investors have a potent tool at their disposal for making better decisions through the use of the VPL.

The VPL evaluates if an investment is financially viable and meets return expectations by taking into account the time value of money, discount rate, and future cash flows.

For individuals interested in investing, utilizing the VPL as a tool for evaluating investments is beneficial. VPL’s accurate analysis capabilities can assist investors in making informed decisions and optimizing the returns on their investments.

While the VPL is useful, it should be part of a broader analysis that includes factors like economic conditions, risk, liquidity, and future projections for informed decision-making.

Drawbacks of employing the VPL

Response: Sensitivity towards interest rates

The VPL is very responsive to the discount rate applied during the calculation. Minor fluctuations in the discount rate can result in significant alterations to the VPL outcome. Therefore, selecting the appropriate discount rate is essential, as any inaccuracies or insufficient estimates can impact investment assessments.

Calculating cash flow can be challenging due to its complexity.

Accurate predictions of future cash flows are necessary for calculating the NPV, which can be difficult in cases of long-term investments or uncertain future revenues and costs.

Mistakes in cash flow calculations can result in incorrect NPV outcomes and impact investment choices.

VPL does not take into account the exact magnitude of the investment.

The VPL assesses the profitability of an investment compared to its initial cost, but it does not consider the investment’s absolute size.

Two projects with equivalent VPLs may differ significantly in their initial costs, impacting the investor’s decision-making process.

Comparing different projects can be challenging due to limitations.

It is crucial that investment projects being compared with the NPV method have comparable cash flows and time frames.

Comparing VPL directly may not be suitable in all cases. Projects with varying durations could result in different VPLs, but this doesn’t indicate superiority of one over the other.

Calculating the net present value (VPL)

To calculate the NPV, consider this scenario: If an investment costing $100 today generates returns of $50 annually for the next three years at an 8% discount rate, what is the resulting NPV?

We will start by identifying the variables from the example, then insert them into the appropriate sections of the VPL formula, and finally solve the formula.

Extract the variables from the given example.

The discount rate is 8% or 0.08.

The investment requires R$ 100 upfront, resulting in an initial cash flow of -R$ 100.

The investment period lasts for 3 years.

The payment will be R$ 50 annually for three years, resulting in R$ 50 each at FC1, FC2, and FC3.

VPL is equal to the sum of FC divided by (1+r) raised to the power of n.

Where is the location?

- FC stands for the anticipated cash flows for each period.

- The discount rate, denoted as r, is the minimum rate of return that an investor expects.

- Time period n represents when cash flows take place.

With a discount rate of 8%, an initial cash flow of -R$100, and a 3-year investment period, we get:

VPL equals the sum of the present values of cash flows: -R$ 100 at time 0, R$ 50 at time 1, R$ 50 at time 2, and R$ 50 at time 3, all discounted at an 8% rate.

(-100 / 1) + (R$ 50 / 1.08) + (R$ 50 / 1.1664) + (R$ 50 / 1.2597)

-100 plus R$ 46.30 plus R$ 42.90 plus R$ 39.70

$28.90

If the Net Present Value (NPV) is negative, the project is not favorable as it will drain the company’s funds. Conversely, with a positive NPV in this scenario, investing in the project could be a wise decision, as a higher positive value indicates greater benefits for the company.

TIR: definition and usage

When evaluating financial investments, two common metrics that frequently come up are the Net Present Value (NPV) and the Internal Rate of Return (IRR).

The VPL calculates the current value of expected cash flows by discounting future cash flows to present value, while the TIR is the discount rate that makes the VPL equal to zero, indicating the investment’s neutral profitability.

TIR, expressed as a percentage, shows the effective return on an investment over its lifespan. It is ideal for the TIR to exceed the discount rate, signaling a profitable investment.

Which metric is best suited for investment analysis: NPV or IRR?

The response is not conclusive and varies based on the investor’s situation and goals. Here are some key factors to keep in mind:

Investment scenarios that are straightforward

VPL is typically better for analyzing consistent and foreseeable cash flows. It is an uncomplicated measure to compute and understand, offering a clear assessment of an investment’s viability and profitability.

Investments with non-traditional payment patterns

If a project features non-traditional cash flows like fluctuating signals (switching between positive and negative) throughout time, IRR may be more suitable.

TIR considers the timing of cash flow reversals, resulting in an effective rate of return that considers these unique characteristics.

Alternative projects compared

When deciding between different investment projects, it is typical to utilize both NPV and IRR for a well-informed choice. NPV enables direct comparison of the projects’ net monetary values, while IRR offers a measure of profitability relative to the discount rate. Generally, projects with positive NPV and IRR greater than the discount rate are deemed more appealing.

Both the VPL and the TIR have limitations as they rely on the assumption that cash flows are reinvested at a fixed rate, which may not always be practical. Selecting the right discount rate can be subjective and influence the outcomes.

In conclusion

The Net Present Value (NPV) is a useful tool for analyzing investments, helping assess project viability and profitability by considering future cash flows and the right discount rate.

By utilizing the VPL, you can make well-informed investment decisions by determining if the projected return exceeds the discount rate employed, allowing you to assess the financial viability of the project.

It is crucial to keep in mind that the net present value (VPL) has its constraints, so it is advisable to use other metrics and pertinent data to enhance your analysis. Financial evaluation necessitates a thorough examination and understanding of various factors.

Comments